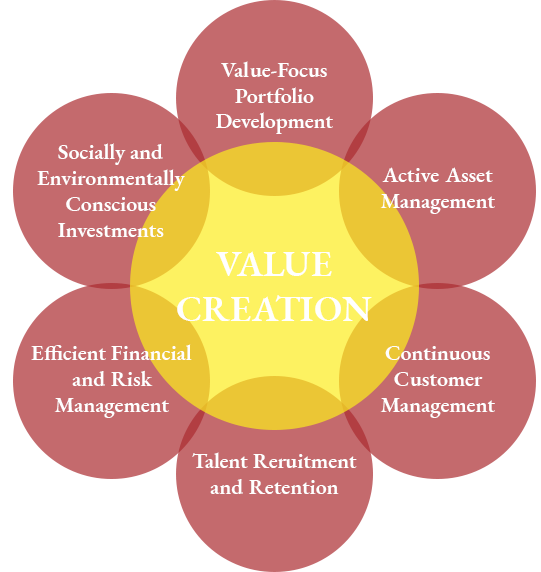

Our purpose is to deliver long-term value for all stakeholders including our clients, customers, team members, internal and external consultants, investors, public administration and the community.

We expect to achieve this through responsible investment in development infrastructure that meets societal and environmental needs both now and into the future. Throughout more than a quarter century journey, we have expanded investments in apartment complexes, public housing, condominiums, shopping malls, hotel & resorts, and manufacturing plants. Maintaining the quality of our products and retaining the reputation of our services is the crucial driver towards an enriched business community. We will be consistently improving our processes to implement projects compulsory to improve the well-being of Myanmar society and beyond.

To become an integral part of Myanmar’s economic reform strategy to promote long-term growth.

We sincerely commit to provide our customers, clients, partners and investors with the highest quality resources through efficiencies, innovations, creativity, under complete ethical conduct for the benefit of all stakeholders.

Our business practices and management team value the importance of sustainable long-term returns to the locals and community, through investments in value-added industries that encourage human resource development and technical advancements.

Mandalay Golden Wing will contribute to the development of human resources and technical advancements by enabling synergy between local and foreign expertise, public and private partnership, centralized and decentralized structures, thus creating a fundamental dynamic that promotes local industries and sectors to exhibit maximum capabilities. We value the significance of talent recruitment, retention and training in providing the finest quality products and services to gain our customers’ trust.

Maintaining the performance of our existing asset portfolio is a key focus; however, we seek to optimize investments in attractive opportunities to expand our portfolio. Asset allocation is determined based on the maturity of the local infrastructure market, investment conditions and the suitability of investment from risk, return and ESG (environmental, societal, governance) perspectives.

Gain trust, Create value

Process, cost & capital efficiency

Human resources, Talent retention

Vocational training, technical advancements

Diversify sectors, local and international partnerships, Synergic network

Promote compliance and ethics, environmental sustainability